Understanding the Basics of Financial History

Financial history is the study of how financial systems, instruments, and markets have evolved over time. It provides valuable insights into the development of economies, the role of financial institutions, and the impact of economic policies. Understanding financial history is crucial for grasping current financial practices and anticipating future trends. This article explores the basics of financial history, current trends, and future predictions.

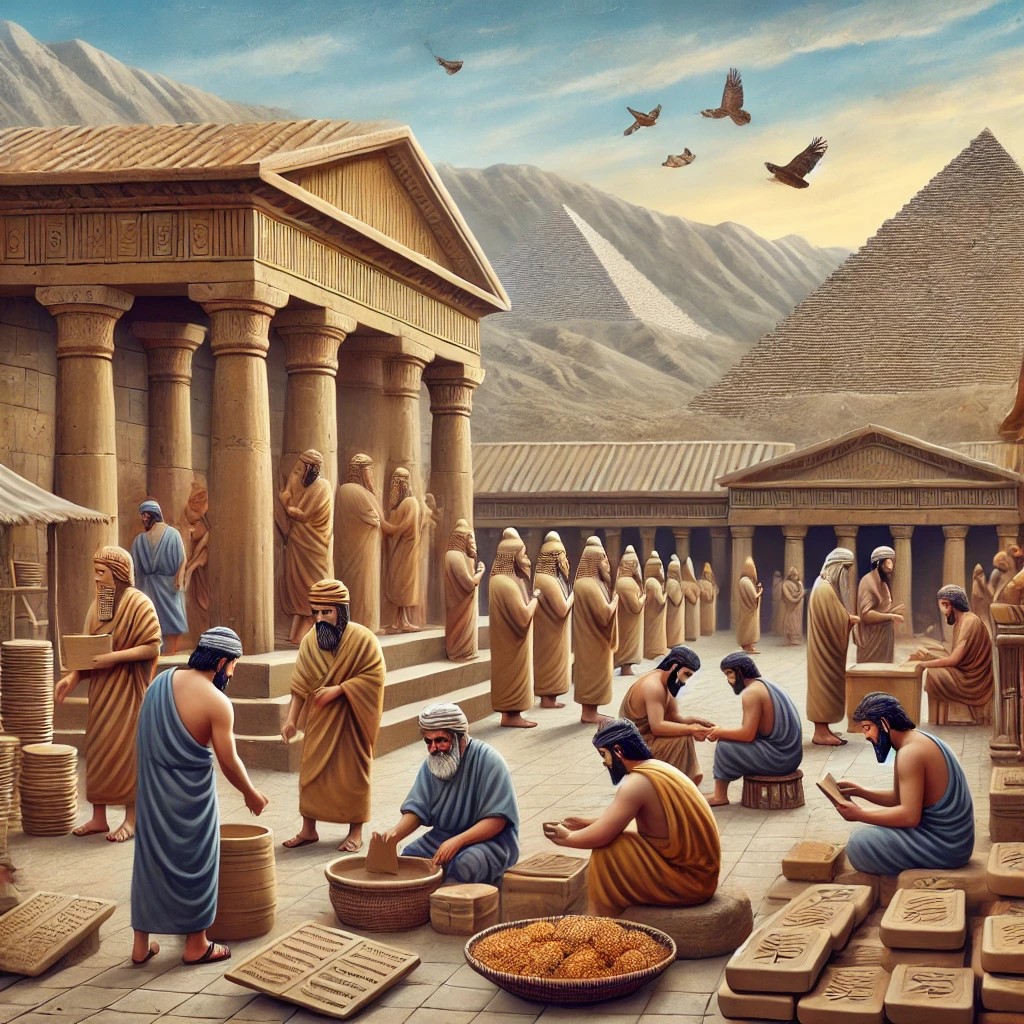

The Evolution of Financial Systems

Ancient and Medieval Finance: Financial systems date back to ancient civilizations, such as Mesopotamia, where records of loans and interest rates were kept on clay tablets. In medieval Europe, banking began to take shape with institutions like the Medici Bank in Florence, which pioneered techniques such as double-entry bookkeeping and letters of credit.

The Rise of Modern Banking: The modern banking system emerged in the 17th and 18th centuries with the establishment of central banks, such as the Bank of England in 1694. These institutions were crucial in managing national currencies, regulating the money supply, and acting as lenders of last resort.

The Industrial Revolution: The 19th century saw rapid industrialization, which fueled the growth of financial markets. Stock exchanges were established, and investment banking began to play a significant role in funding industrial enterprises. This period also witnessed the rise of financial instruments like bonds and stocks.

Current Trends

Technological Advancements: Technology is reshaping financial systems at an unprecedented pace. Innovations like blockchain, artificial intelligence (AI), and fintech platforms are transforming how financial transactions are conducted, increasing efficiency, and reducing costs.

Increased Regulation: In response to the 2008 financial crisis, there has been a push for greater regulation and oversight of financial markets. Regulations such as the Dodd-Frank Act in the United States aim to reduce systemic risk and protect consumers.

Sustainable Finance: There is a growing emphasis on sustainable finance, which integrates environmental, social, and governance (ESG) criteria into investment decisions. This trend reflects a broader recognition of the role of finance in promoting sustainable development and addressing global challenges like climate change.

Future Predictions

Further Integration of Technology: The future of finance will be heavily influenced by technological advancements. AI and machine learning will enhance predictive analytics, risk management, and personalized financial services. Blockchain technology will continue to revolutionize areas like payments, settlements, and identity verification.

Evolution of Central Banking: Central banks will adapt to new challenges, such as digital currencies and the need for greater financial stability. The development of central bank digital currencies (CBDCs) will be a significant trend, offering more efficient and secure payment systems.

Conclusion

Understanding the basics of financial history is essential for navigating the complexities of modern finance. From ancient banking practices to the rise of cryptocurrencies, financial history provides valuable lessons and insights. Current trends such as technological advancements, increased regulation, sustainable finance, and digital assets are shaping the future of financial systems. By staying informed about these developments, investors, policymakers, and financial professionals can make better decisions and contribute to a more stable and inclusive financial landscape.

(Writer:Haicy)